South Africa’s South Deep gold mine sells 20% more gold in latest quarter

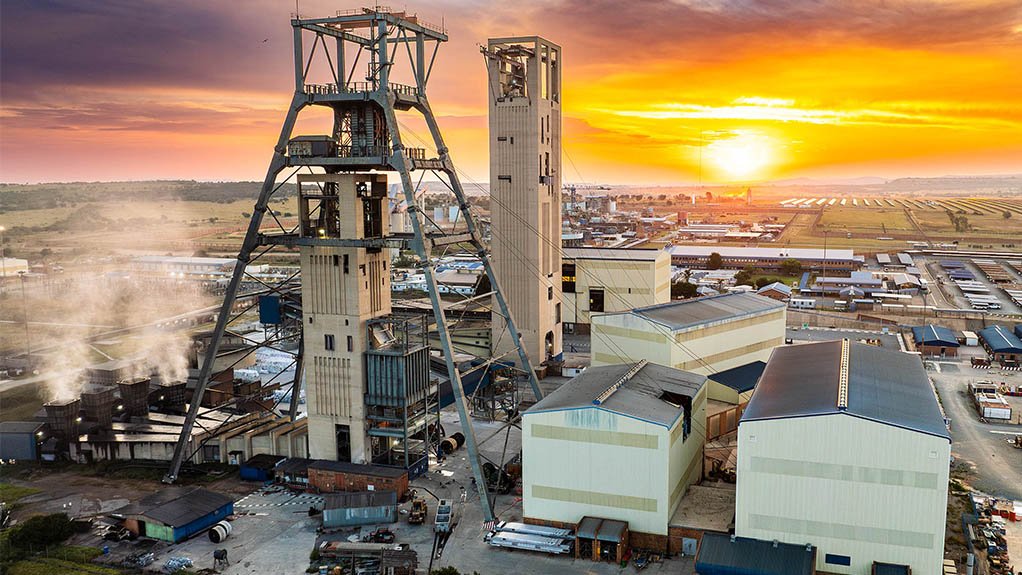

JOHANNESBURG (miningweekly.com) – The South Deep gold mine in South Africa’s Gauteng province sold 20% more gold in the September quarter and 22% more gold than in the corresponding quarter of last year.

The 86 300 oz of third-quarter gold sold was well up on the 70 800 oz sold in the corresponding three months to 30 September 2024.

On the production front, the bulk mechanised mining operation 50 km south-west of Johannesburg, had another steady performance in the three months to 30 September 2025, producing 78 000 oz and meeting its plan for the quarter.

Moreover, all-in costs (AIC) in rand terms were 3% lower quarter-on-quarter mainly on more gold sold, illustrating the extent of the asset's leverage to increasing volumes.

“The team continues to make good progress in improving stope turnaround which is key to driving efficiency and realising incremental gains,” Gold Fields CEO Mike Fraser stated in a media release to Mining Weekly.

The 432 000 t of ore milled in the September quarter was 5% up on the June quarter and the grade of the underground reef mined was 2% higher at 6.14 g/t, the Johannesburg Stock Exchange-listed Gold Fields reported.

Sustaining capital expenditure (capex) of R582.6-million in the September quarter was 17% higher than in the June quarter.

Owing mainly to the increased volume of gold sold, AIC was a lower R1 029 496/kg, partially offset by higher capex of R583-million in the September quarter, up from the June quarter’s R500-million.

The main expenditure items relate to the winders, underground infrastructure maintenance of tips and the underground collision avoidance system.

The September 2025 quarter compared with the September 2024 quarter recorded an 8% higher gold production driven by improved plant recovery and mine call factors.

The 2% higher rand AIC was mainly owing to the higher cost of sales before amortisation and depreciation and capex in the September 2025 quarter partially offset by the higher gold sold.

In the overall operational update for the quarter ended September 30, all-inclusive attributable production was a 6%-higher 621 000 oz, all-in sustaining costs were a 10%-lower $1 557/oz, and AIC an 11%-lower $1 835/oz compared with the three months to June 30.

In maintaining the positive momentum of the first half of the year, the company continued to focus on multi-year safety improvement plan.

“Although we have had five consecutive quarters fatality-free, we had three serious injuries in the quarter, demonstrating the need for continued focus and effort in our safety journey,” Fraser reported.

Net debt decreased to $791-million driven by strong cash generation, partially offset by the payment of the interim dividend of $36-million.

The net debt-to-earnings ratio was 0.17x at the end of the September quarter, compared with 0.37x in the June quarter.

Post the quarter-end, Gold Fields completed the acquisition of Gold Road Resources and paid $1.45-billion. The purchase was funded using an underwritten bridge facility of $2.3-billion.

Following the completion of the Gold Road transaction on October 14, attributable production from Gruyere will be 100% for most of this year’s last quarter.

In Ghana, Tarkwa's production was a 15%-higher 123 000 oz on higher feed grade and fourth-quarter production is expected to increase further.

In South America, Salares Norte produced 112 000 gold equivalent third-quarter ounces with 2025 guidance of 325 000 to 375 000 gold equivalent ounces, at an all-in sustaining cost of $975 to $1 125 per equivalent ounce.

In Australia, construction of the 35 MW solar plant and 42 MW wind plant at the St Ives gold mine is 80% complete. All solar photovoltaic panels have been installed and electrical connections are underway.

The wind turbine parts are being delivered to site. Once completed solar and wind are expected to deliver more than 70% of the mine's electricity requirements and reduce its electricity costs to a third of the current costs.

At Granny Smith, also in Australia, the 11 MW solar plant is operating at full capacity on a site that now has a total of 19 MW of solar capacity and 9 MW battery storage, with 20% of its electricity being generated from solar power in September.

LEADERSHIP CHANGES

After eight years at Gold Fields, Martin Preece retired on August 31. Following Preece's retirement, Francois Swanepoel was appointed COO. Swanepoel was previously chief technical officer and Jason Sander has been appointed acting chief technical officer.

UNCHANGED GUIDANCE

Gold Fields remains on track to meet the production and cost guidance provided in February 2025. Attributable gold-equivalent production is expected to be in the upper end of the guidance range of 2.250-million ounces to 2.450-million ounces. All-in sustaining costs are expected to be between $1 500/oz and $1 650/oz, and all-in costs at between $1 780/oz and $1 930/oz.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation